Regulatory, Political

and Policy Issues

Trump Brings Sweeping Change

Regulatory, Political

and Policy Issues

Trump Brings Sweeping Change

U.S. President Donald Trump has been outspoken about his intention to reverse many of the Biden administration’s clean energy initiatives, in addition to signaling a shift in the approach to international trade and oil & gas regulation. We expect the second Trump presidency to see the repeal of many of Biden’s actions on climate change and the environment, including policies related to environmental justice. This will coincide with a change of leadership also at the Federal Trade Commission (FTC), which will impact antitrust enforcement and competition.

Public Policy

A Potential End to the All-of-Government Focus on Climate Change and Environmental Justice

First 100 Days

The first weeks of the new administration will inevitably include Executive Orders on expanding oil & gas development on public lands and offshore through new lease and auction processes. There also will be efforts to repeal and replace Environmental Protection Agency (EPA) final rules governing power plants to remove a requirement that carbon capture, utilization & storage (CCUS) be used on new natural gas-fired power plants.

The U.S. Department of Energy’s decision to pause authorizations of liquefied natural gas (LNG) exports to non-Free Trade Agreement countries, a controversial decision directed by former President Biden in January 2024, will be lifted straight away. However, holdovers from the Biden administration, including new studies on the environmental and domestic economic impacts of greater LNG exports to be published imminently prior to President Trump taking office, could make full repeal of the policy more complicated in the wake of new climate change and environmental justice data.

U.S. President Donald Trump has been outspoken about his intention to reverse many of the Biden administration’s clean energy initiatives, in addition to signaling a shift in the approach to international trade and oil & gas regulation. We expect the second Trump presidency to see the repeal of many of Biden’s actions on climate change and the environment, including policies related to environmental justice. This will coincide with a change of leadership also at the Federal Trade Commission (FTC), which will impact antitrust enforcement and competition.

Public Policy

A Potential End to the All-of-Government Focus on Climate Change and Environmental Justice

First 100 Days

The first weeks of the new administration will inevitably include Executive Orders on expanding oil & gas development on public lands and offshore through new lease and auction processes. There also will be efforts to repeal and replace Environmental Protection Agency (EPA) final rules governing power plants to remove a requirement that carbon capture, utilization & storage (CCUS) be used on new natural gas-fired power plants.

The U.S. Department of Energy’s decision to pause authorizations of liquefied natural gas (LNG) exports to non-Free Trade Agreement countries, a controversial decision directed by former President Biden in January 2024, will be lifted straight away. However, holdovers from the Biden administration, including new studies on the environmental and domestic economic impacts of greater LNG exports to be published imminently prior to President Trump taking office, could make full repeal of the policy more complicated in the wake of new climate change and environmental justice data.

IRA Repeal

With narrow control of both chambers of Congress, the new government also will be able to prioritize taxes in the budget reconciliation process. Requiring only a simple majority to support a budget reconciliation resolution, we can expect that Congress will attempt to repeal the tax credits enacted in the IRA and renew the tax provisions that were passed in the 2017 Tax Cuts and Jobs Act. We think it unlikely that a full repeal of the IRA will occur and that significant elements will survive. We could also see Congress add domestic content rules similar to the section 30D provision rules to other IRA provisions.

The electric vehicle industry may be most at risk while tax credits tied to hydrocarbons, such as CCUS and 45V clean hydrogen, are most likely to remain. The statute’s so-called “methane fee,” which directs EPA to collect a Waste Emissions Charge on methane released from certain oil and gas facilities at a rate to increase to $1,500 per metric ton, could be repealed. At the agency level, new leadership at the U.S. Department of Treasury could amend guidance for tax credits to permit natural gas-derived hydrogen to be eligible for the 45V tax credit, assuming the credit is not repealed.

IRA Repeal

With narrow control of both chambers of Congress, the new government also will be able to prioritize taxes in the budget reconciliation process. Requiring only a simple majority to support a budget reconciliation resolution, we can expect that Congress will attempt to repeal the tax credits enacted in the IRA and renew the tax provisions that were passed in the 2017 Tax Cuts and Jobs Act. We think it unlikely that a full repeal of the IRA will occur and that significant elements will survive. We could also see Congress add domestic content rules similar to the section 30D provision rules to other IRA provisions.

The electric vehicle industry may be most at risk while tax credits tied to hydrocarbons, such as CCUS and 45V clean hydrogen, are most likely to remain. The statute’s so-called “methane fee,” which directs EPA to collect a Waste Emissions Charge on methane released from certain oil and gas facilities at a rate to increase to $1,500 per metric ton, could be repealed. At the agency level, new leadership at the U.S. Department of Treasury could amend guidance for tax credits to permit natural gas-derived hydrogen to be eligible for the 45V tax credit, assuming the credit is not repealed.

Natural Gas as a Solution

Natural gas will be highlighted more under Trump as the best solution to fuel the rapid growth in load demand from data centers and to fuel U.S. competition with China on artificial intelligence, and also as a mechanism to control and reduce greenhouse gas emissions. The new administration will likely continue the Biden White House’s focus on the massive load demand growth anticipated in the near future. The new White House, however, will shift focus from renewable energy and transmission planning to firm power production from natural gas and coal.

We anticipate the Trump energy team will call for a slowing of retirements at fossil fuel-power generation facilities, consistent with its approach in President Trump’s first term.

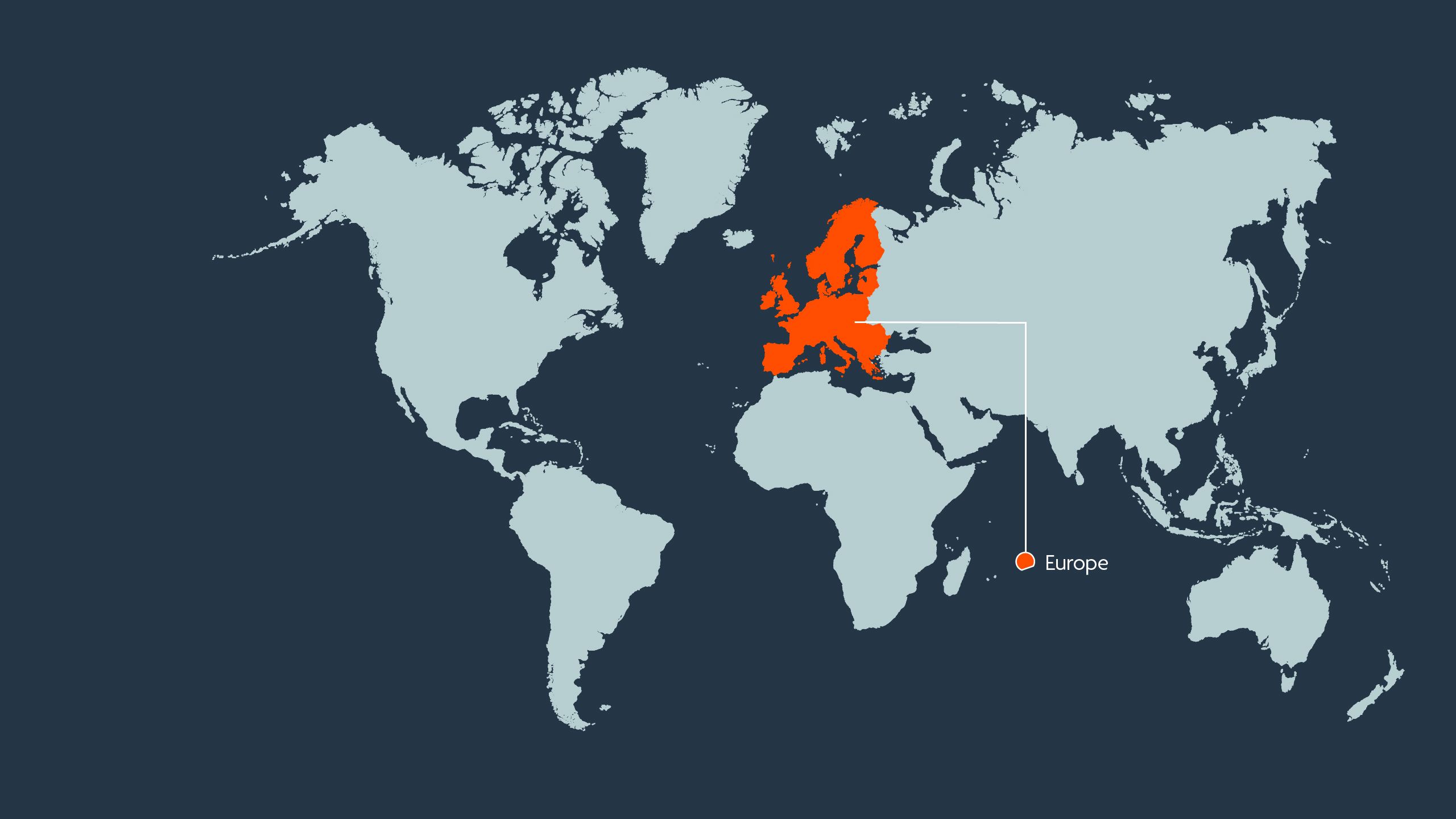

International Relations

In some of her first comments following President Trump’s electoral victory, European Commission (EC) President Ursula von der Leyen noted to potential for discussing replacing Russian gas with U.S. LNG in Europe. As such, there will be a renewed LNG diplomacy with Europe. Energy will also provide a potential platform for closer work between the Trump administration and European leaders on Ukrainian support issues, as well as China-related issues.

Natural Gas as a Solution

Natural gas will be highlighted more under Trump as the best solution to fuel the rapid growth in load demand from data centers and to fuel U.S. competition with China on artificial intelligence, and also as a mechanism to control and reduce greenhouse gas emissions. The new administration will likely continue the Biden White House’s focus on the massive load demand growth anticipated in the near future. The new White House, however, will shift focus from renewable energy and transmission planning to firm power production from natural gas and coal.

We anticipate the Trump energy team will call for a slowing of retirements at fossil fuel-power generation facilities, consistent with its approach in President Trump’s first term.

International Relations

In some of her first comments following President Trump’s electoral victory, European Commission (EC) President Ursula von der Leyen noted to potential for discussing replacing Russian gas with U.S. LNG in Europe. As such, there will be a renewed LNG diplomacy with Europe. Energy will also provide a potential platform for closer work between the Trump administration and European leaders on Ukrainian support issues, as well as China-related issues.

International Relations & Trade

Revisiting Sanctions Regimes, Imposing Tariffs

Expect More Tariffs

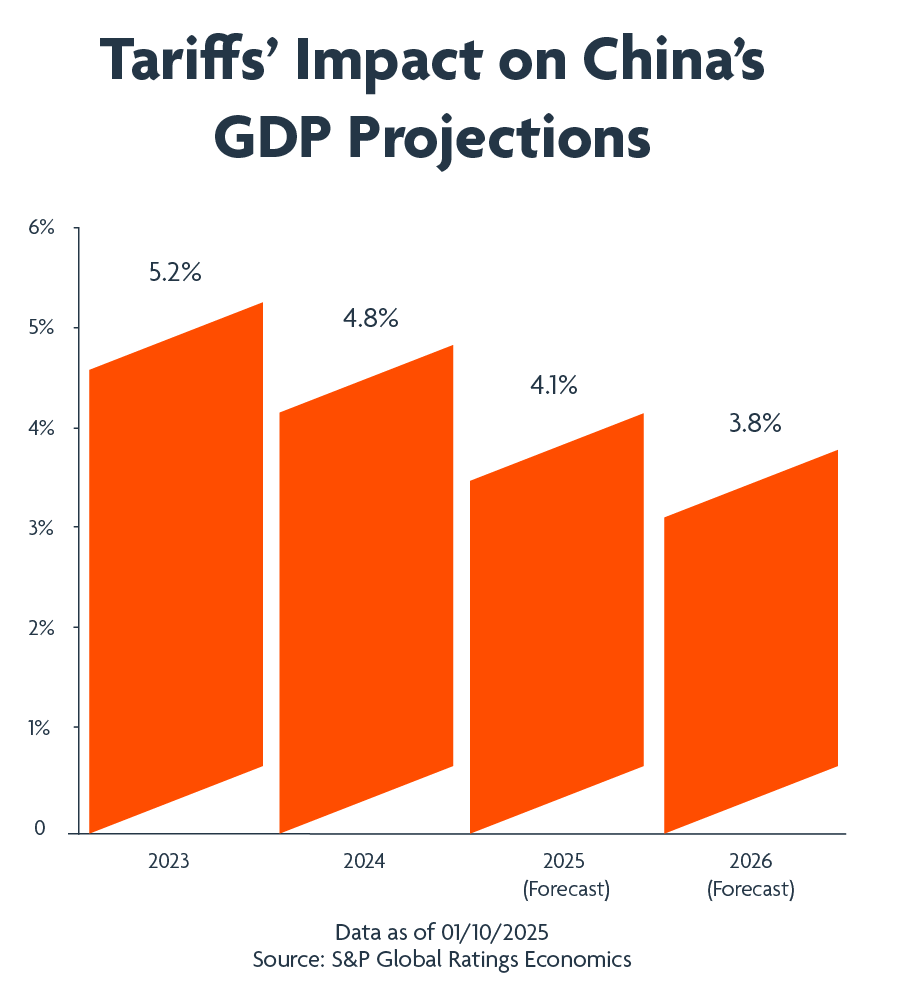

Trump has made clear an intention to lower America’s trade deficit, arguing for a renegotiation of trade deals and new tariffs. Tariffs under the new administration will likely hit steel, aluminum, concrete and other products critical to energy infrastructure and hydrocarbon production.

International Relations & Trade

Revisiting Sanctions Regimes, Imposing Tariffs

Expect More Tariffs

Trump has made clear an intention to lower America’s trade deficit, arguing for a renegotiation of trade deals and new tariffs. Tariffs under the new administration will likely hit steel, aluminum, concrete and other products critical to energy infrastructure and hydrocarbon production.

Russia

Although the Trump administration has generally signaled less appetite to provide military funding to Ukraine, it seems unlikely that the new government will seek to lift or substantially ease the current sanctions on Russia without first negotiating something significant in return through Russia-Ukraine peace treaty negotiations. In other words, the Trump administration may seek to use the sanctions as bargaining chips in furtherance of the President’s stated goal of bringing a swift end to the war.

Further, even if the Trump administration were to attempt to lift or substantially ease Russian sanctions, there would likely be substantial opposition in Congress. During the prior Trump administration, Congress overwhelmingly enacted the Countering America’s Adversaries Through Sanctions Act (which codified certain Russia sanctions and imposed certain mandatory secondary sanctions on Russia) in part as a rebuke to the Trump administration’s perceived unwillingness to sanction the Russian government for the array of malign acts Russia commits against the U.S., United Kingdom (U.K.), European Union (EU) member states and other U.S. partners and allies. If Congress feels compelled to enact similar legislation during this Trump administration, it seems likely that it will have the supermajority necessary to override any presidential vetoes, which will limit Trump’s ability to take unilateral executive actions to materially weaken the Russia-related sanctions program.

Maroš Šefčovič was appointed as the new European Commissioner for Trade and Economic Security in September 2024 and could potentially pursue a more aggressive approach to sanctions against Russia than seen to date.

Middle East

The major oil & gas companies of the Middle East continue to prioritize energy transition, with state-owned entities making investments to shift their focus from national oil companies into globally integrated energy giants. Gulf leaders broadly favored Trump as the next U.S. president, appreciating his support for traditional hydrocarbons while recognizing his promises to ramp up U.S. oil & gas production will likely impact the revenues of governments in the Middle East.

With respect to Iran, the Trump administration will almost certainly resume its “maximum pressure” campaign against Iran and its proxies, including the Houthi rebels, Hezbollah and Hamas. That said, given the significant number and array of sanctions already in place against Iran and its proxies, these sanctions are unlikely to have a significant real-world impact.

The bigger question will be the extent to which the Trump administration will impose sanctions on Chinese companies that support Iran’s oil trade, which could have a broader impact on global energy markets. Congress overwhelmingly supports such sanctions, increasing the likelihood that they will go ahead.

Venezuela

If the Trump administration resumes its prior “maximum pressure” campaign against the Maduro regime in Venezuela, one aspect of that re-escalation could be the revocation of recently issued Office of Foreign Assets Control specific licenses. The Biden administration has issued to certain U.S. and non-U.S. energy companies specific licenses to encourage the flow of Venezuelan oil into global markets to offset instability arising from the Russia-related sanctions and other factors.

China

The prior Trump administration did not hesitate to impose sanctions on major Chinese companies, even if those actions involved litigation risk and/or ultimately resulted in court defeats. This administration will likely resume its aggressive approach to sanctions on Chinese companies and might even consider imposing full-blocking sanctions—the most potent tool in the President’s sanctions toolkit—on major Chinese companies operating in the energy sector.

Europe

So far, they have taken a different approach than the U.S. on China, particularly as it relates to the German automotive industry and the dependency of many European supply chains on Chinese imports. As such, given Trump has also indicated his appetite for sanctions that will impact Europe, it will be interesting to see how unilateral the new administration in Washington, D.C. will be in its approach.

Antitrust

Return to Traditional Antitrust

We expect that a second Trump administration will signal a major shift in the antitrust environment for oil & gas M&A. Current FTC Chair Lina Khan has taken an aggressive approach towards antitrust issues in the sector since her appointment in 2021. Her Republican successor will change that dynamic, likely returning to traditional antitrust enforcement principles thereby reducing the uncertainty regarding M&A in the sector and spurring further consolidation in the wake of Exxon/Pioneer and Chevron/Hess.

- Reduced Scrutiny of E&P Transactions: The FTC under Khan closely scrutinized large, high-profile transactions in exploration and production. While the FTC did not seek to block any of these transactions, a rise in Second Request responses triggered increased transaction costs and lengthened the timeline to a deal’s closure.

- Returned Focus to Core Antitrust Issues: Khan’s FTC obtained consent decrees on ancillary issues in three oil & gas mergers despite concluding that the underlying transactions did not raise competitive concerns. A Trump administration will likely return to a traditional antitrust approach.

- Deals That Raise Antitrust Concerns Will Still Face Scrutiny: For example, we expect the FTC to continue to scrutinize midstream transactions that increase concentration or create bottlenecks in the supply chain. Likewise, oilfield services and equipment and retail fuel outlets are also areas that both Democrat and Republican administrations have consistently scrutinized in the past. So, while we expect to see reduced interest in the oil & gas industry overall, parties to transactions that may raise antitrust concerns can still expect scrutiny.

Antitrust

Return to Traditional Antitrust

We expect that a second Trump administration will signal a major shift in the antitrust environment for oil & gas M&A. Current FTC Chair Lina Khan has taken an aggressive approach towards antitrust issues in the sector since her appointment in 2021. Her Republican successor will change that dynamic, likely returning to traditional antitrust enforcement principles thereby reducing the uncertainty regarding M&A in the sector and spurring further consolidation in the wake of Exxon/Pioneer and Chevron/Hess.

- Reduced Scrutiny of E&P Transactions: The FTC under Khan closely scrutinized large, high-profile transactions in exploration and production. While the FTC did not seek to block any of these transactions, a rise in Second Request responses triggered increased transaction costs and lengthened the timeline to a deal’s closure.

- Returned Focus to Core Antitrust Issues: Khan’s FTC obtained consent decrees on ancillary issues in three oil & gas mergers despite concluding that the underlying transactions did not raise competitive concerns. A Trump administration will likely return to a traditional antitrust approach.

- Deals That Raise Antitrust Concerns Will Still Face Scrutiny: For example, we expect the FTC to continue to scrutinize midstream transactions that increase concentration or create bottlenecks in the supply chain. Likewise, oilfield services and equipment and retail fuel outlets are also areas that both Democrat and Republican administrations have consistently scrutinized in the past. So, while we expect to see reduced interest in the oil & gas industry overall, parties to transactions that may raise antitrust concerns can still expect scrutiny.

In Europe, the Commission has a new slate of Commissioners, including a new Executive Vice President for a Clean, Just and Competitive Transition, Teresa Ribera. This is the first time that the EC has folded the competition portfolio alongside energy, suggesting a clear interlinkage in European thinking around using enforcement pressure to promote a clean transition.

The last few years have seen a greater focus on sustainability when reviewing commercial agreements, partnerships and acquisitions, both within and outside of the traditional energy arena, in markets such as plastics and fast-moving consumer/household goods. This policy is set to continue, such that arrangements and transactions that might previously have been considered anticompetitive in one or more markets may now be easier to justify (including with commitments) on the grounds of sustainability or other relevant customer benefits.

In Europe, the Commission has a new slate of Commissioners, including a new Executive Vice President for a Clean, Just and Competitive Transition, Teresa Ribera. This is the first time that the EC has folded the competition portfolio alongside energy, suggesting a clear interlinkage in European thinking around using enforcement pressure to promote a clean transition.

The last few years have seen a greater focus on sustainability when reviewing commercial agreements, partnerships and acquisitions, both within and outside of the traditional energy arena, in markets such as plastics and fast-moving consumer/household goods. This policy is set to continue, such that arrangements and transactions that might previously have been considered anticompetitive in one or more markets may now be easier to justify (including with commitments) on the grounds of sustainability or other relevant customer benefits.

Energy Regulation

FERC Will Get a New Chair

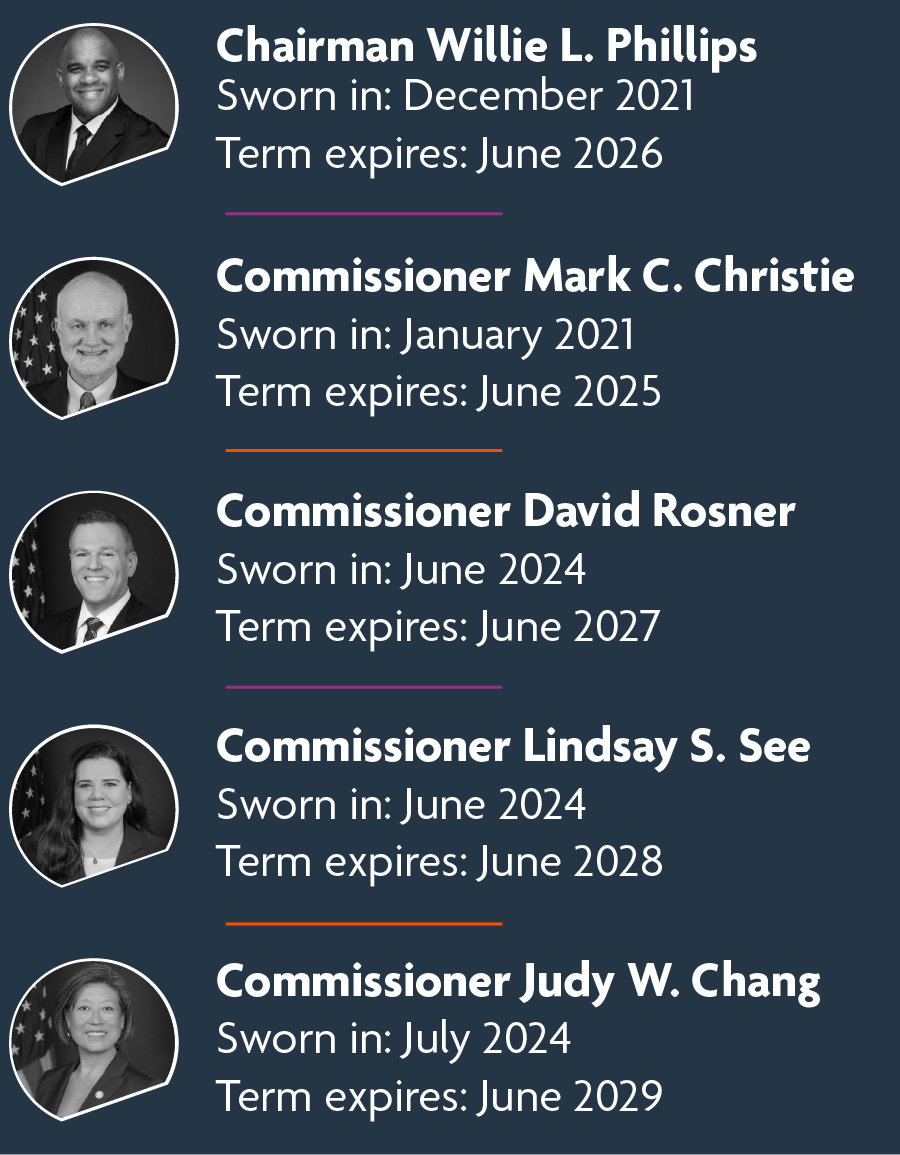

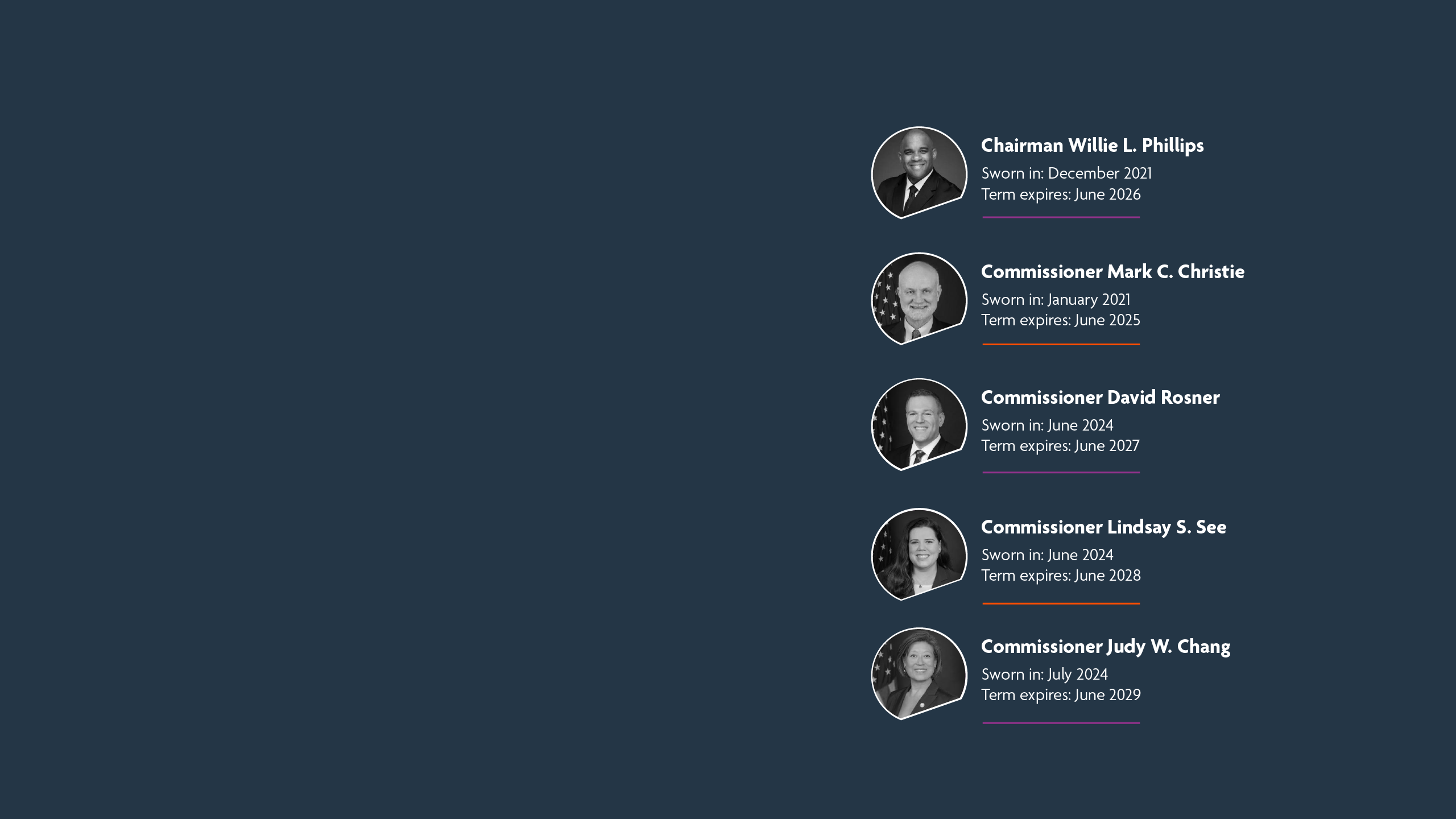

Federal Energy Regulatory Commission (FERC) Makeup

The FERC chairmanship will pass to a Republican, from current Chairman Willie Phillips, on January 20, 2025. While policy preferences, including direction from the agency’s Office of General Counsel, will change, FERC may continue to have a 3-2 Democratic majority until Phillips’ term expires in June 2026. While Phillips could choose to resign and open the seat for President Trump to fill, there is precedent for former agency chairs to remain in place rather than give the President the opportunity to appoint a new Commissioner. Were he to resign to open the seat, with three of the agency’s five commissioners joining in 2024, FERC would lose some of the institutional overlap that traditionally knits the agency across presidential administrations.

Will Bipartisan Reign?

Under Chairman Phillips, the agency has taken a more bipartisan approach and voted out more unanimous orders than prior commissions. Whether that continues in the short-term will depend on who President Trump appoints to lead the agency and whether Chairman Phillips resigns his seat or continues to serve. If the composition remains, expect continued support for infrastructure development, including pipeline and LNG terminal projects, with the caveat that the agency’s reviews seem to be becoming more susceptible to reversal in the D.C. Circuit following the Supreme Court’s decision in Loper Bright Enterprises v. Raimondo. The agency, aware of this trend, has also adapted the orders it writes.

Environmental Justice

Chairman Phillips has stated that he hopes the new chairman will continue to support the agency’s efforts on outreach to environmental justice communities even after the expected repeal of Biden administration Executive Orders calling for a government-wide approach. While FERC was expected to update its regulations implementing the National Environmental Policy Act (NEPA) to align with new Council on Environmental Quality (CEQ) regulations codifying environmental justice concepts, a recent D.C. Circuit decision calls the CEQ regulations into question. Regardless, these changes will not lessen FERC’s statutory obligations to consult with Indian Tribes, and many of the environmental justice community issues may fall into the Tribal consultation space. As was the case during the first Trump administration, we can also expect an increase in environmental activism as a result.

Energy Regulation

FERC Will Get a New Chair

Federal Energy Regulatory Commission (FERC) Makeup

The FERC chairmanship will pass to a Republican, from current Chairman Willie Phillips, on January 20, 2025. While policy preferences, including direction from the agency’s Office of General Counsel, will change, FERC may continue to have a 3-2 Democratic majority until Phillips’ term expires in June 2026. While Phillips could choose to resign and open the seat for President Trump to fill, there is precedent for former agency chairs to remain in place rather than give the President the opportunity to appoint a new Commissioner. Were he to resign to open the seat, with three of the agency’s five commissioners joining in 2024, FERC would lose some of the institutional overlap that traditionally knits the agency across presidential administrations.

Will Bipartisan Reign?

Under Chairman Phillips, the agency has taken a more bipartisan approach and voted out more unanimous orders than prior commissions. Whether that continues in the short-term will depend on who President Trump appoints to lead the agency and whether Chairman Phillips resigns his seat or continues to serve. If the composition remains, expect continued support for infrastructure development, including pipeline and LNG terminal projects, with the caveat that the agency’s reviews seem to be becoming more susceptible to reversal in the D.C. Circuit following the Supreme Court’s decision in Loper Bright Enterprises v. Raimondo. The agency, aware of this trend, has also adapted the orders it writes.

Environmental Justice

Chairman Phillips has stated that he hopes the new chairman will continue to support the agency’s efforts on outreach to environmental justice communities even after the expected repeal of Biden administration Executive Orders calling for a government-wide approach. While FERC was expected to update its regulations implementing the National Environmental Policy Act (NEPA) to align with new Council on Environmental Quality (CEQ) regulations codifying environmental justice concepts, a recent D.C. Circuit decision calls the CEQ regulations into question. Regardless, these changes will not lessen FERC’s statutory obligations to consult with Indian Tribes, and many of the environmental justice community issues may fall into the Tribal consultation space. As was the case during the first Trump administration, we can also expect an increase in environmental activism as a result.

Conclusion

Change Is the Only Certainty in Year Ahead

As the new U.S. government settles in, there will be a markedly different approach to trade policy and oil & gas regulation through 2025. Alongside a rolling back of policies that support clean energy, we can expect more tariffs to support the domestic U.S. industry, a revisiting of sanctions regimes, reduced antitrust scrutiny and a shift in tone when it comes to international relations.

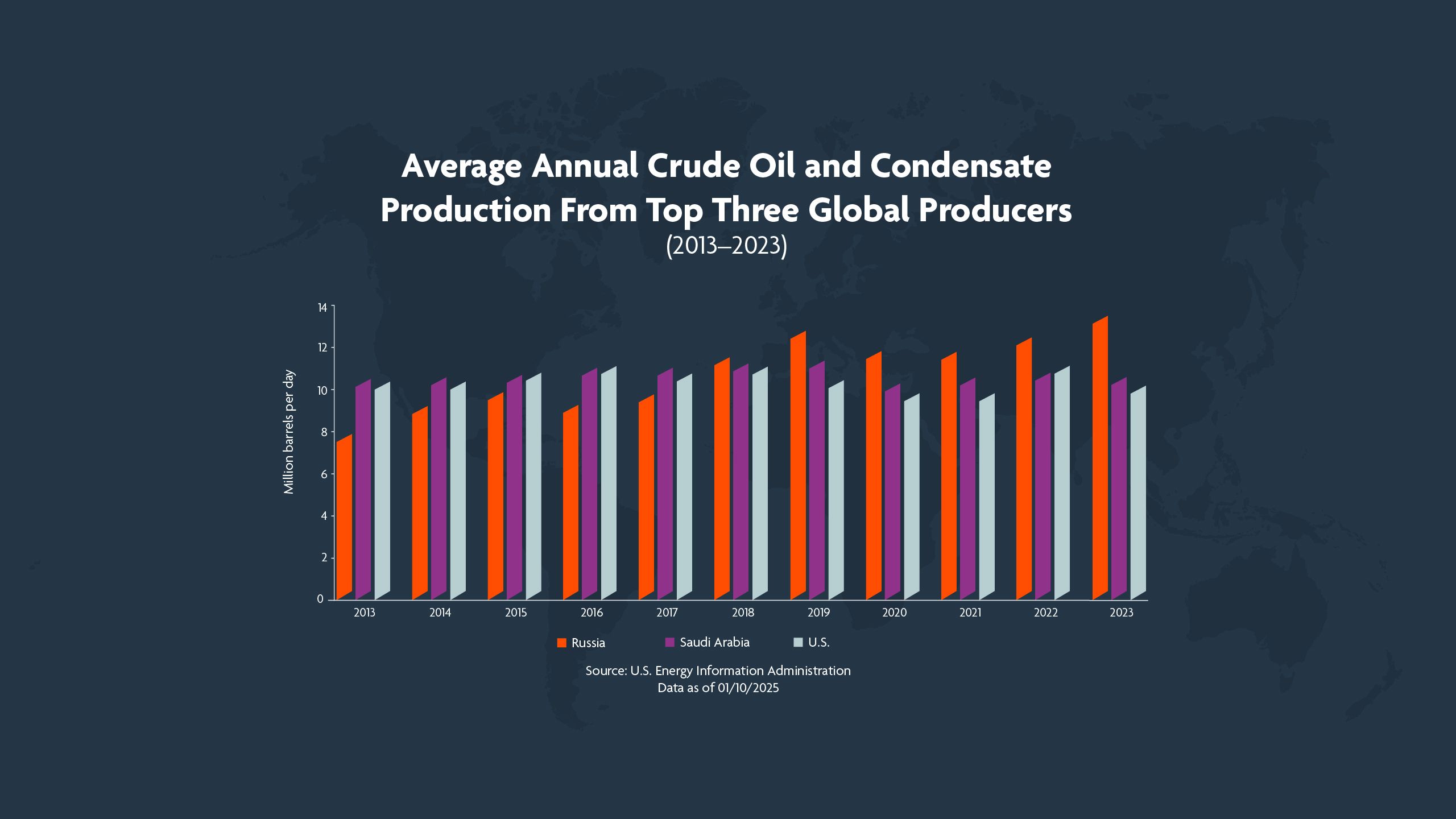

Governments in Europe and the Middle East will be paying close attention to U.S. energy policy as it pertains to Russia and the Gulf states in particular. It remains to be seen how Trump’s aspiration to unleash significantly more oil & gas domestically will impact global markets in the years ahead.

Conclusion

Change Is the Only Certainty in Year Ahead

As the new U.S. government settles in, there will be a markedly different approach to trade policy and oil & gas regulation through 2025. Alongside a rolling back of policies that support clean energy, we can expect more tariffs to support the domestic U.S. industry, a revisiting of sanctions regimes, reduced antitrust scrutiny and a shift in tone when it comes to international relations.

Governments in Europe and the Middle East will be paying close attention to U.S. energy policy as it pertains to Russia and the Gulf states in particular. It remains to be seen how Trump’s aspiration to unleash significantly more oil & gas domestically will impact global markets in the years ahead.